owe state taxes illinois

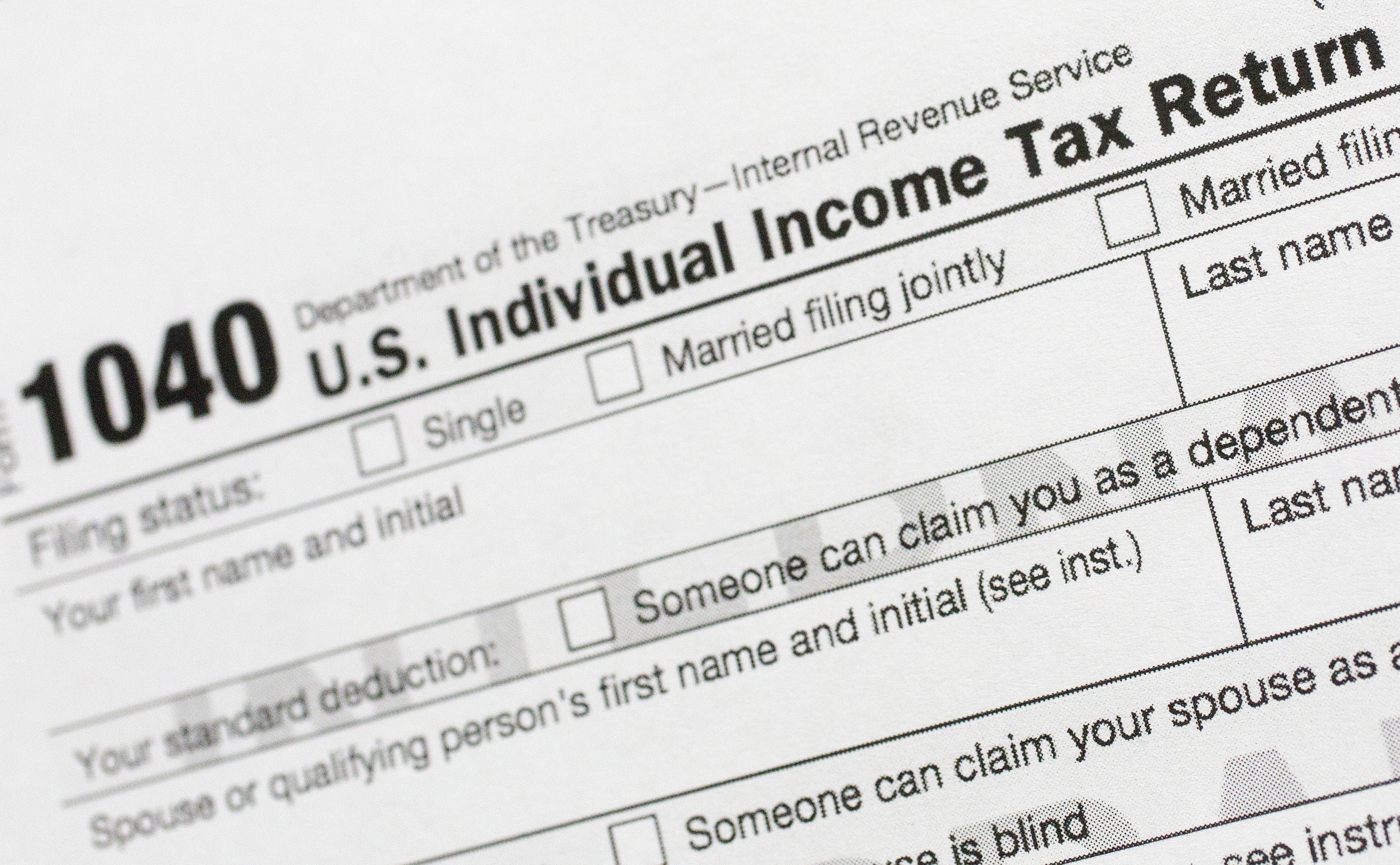

Illinois bases its 5 percent state income tax on your federal adjusted gross income plus or minus state-specific income adjustments. End Your IRS Tax Problems - Free Consult.

Where S My Illinois State Tax Refund Il Tax Brackets Taxact

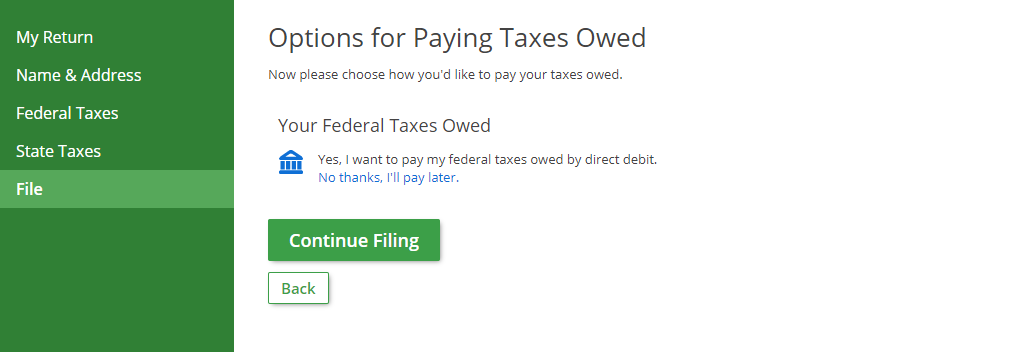

If you dont already have a MyTax Illinois account click here.

. Ad Do You Need To Set Up An Illinois State Installment Plan. That makes it relatively easy to predict the income tax you. Up to 25 cash back If your estate owes estate tax how much will it actually owe.

We may ask the Internal Revenue Service to. A late-payment penalty for tax not paid by the original due date of the return. Each state has different tax.

A 2018 study by WalletHub found that collectively residents of Illinois face the highest tax burden in the entire country. A late-filing penalty if you do not file a return that we can process by the extended due date. Tax Relief up to 96 See if You Qualify For Free.

The Comptrollers Office may offset any money that the Illinois state government owes you and apply that amount to your delinquent tax liability. Free Confidential Consult. If your total tax liability for the year is.

Federal and state tax laws and regulations are not the same. Ad We Can Solve Any Tax Problem. Take Advantage of Fresh Start Options.

Ad See if you ACTUALLY Can Settle for Less. 600 or less you may pay the tax for the entire year January 1 through December 31 by. Motor Fuel Retailer Sign - Effective July 1 2022 through December 31 2022 Public Act 102-0700 requires a notice to be posted in a prominently visible place on each retail dispensing device.

Answers others found helpful. Illinois currently withholds 24 percent in federal taxes and 495 percent in state income taxes though that may not be the total tax obligation depending on the winners. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Ad See if you ACTUALLY Can Settle for Less. Affordable Reliable Services. Ad BBB Accredited A Rating.

You can figure out what your take. Do You Need To Set Up An Illinois State Payment Plan. The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate.

The Illinois income tax was lowered from 5 to. You are still an Illinois resident even if you go to school in another state. It is possible to owe Illinois taxes and get a refund from your federal return in the same year.

Free Confidential Consult. Affordable Reliable Services. Quickly End IRS State Tax Problems.

The late-payment penalty amount is based on the number of days the payment is late. Its tax sits at 133. The Different Types of.

For non-retirees calculating Illinois income tax is fairly easy as the state has a flat tax of 495 that applies to everyone regardless of income. California for instance has the highest state income tax rate in the United States. Take Advantage of Fresh Start Options.

The Illinois Federal State Exchange is saying I owe them 10k in back taxes for not filing in 2017 and. You can learn more about how the Illinois income tax compares to other states income taxes by visiting our map of income taxes by state. Find Out Now If You Qualify.

The use tax due date is based on how much use tax you owe. Vehicle use tax bills RUT series tax forms must be paid by check. In Illinois the tax rate currently ranges from 08 to 16 depending on the size of the estate.

Download Or Email IL-1040 More Fillable Forms Register and Subscribe Now. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. There are 43 states that collect state income taxes.

Also you may want to check the revenue department in the state where you worked. Ad Use our tax forgiveness calculator to estimate potential relief available. Payments less than 31 days late are penalized at 2 of the amount due and payments 31 days late are.

Ad See How Long It Could Take Your 2021 State Tax Refund. Illinois is saying I owe them state taxes but I didnt live or work there. Whether you are running a small business or trying to.

Find Out If You Qualify. Check or money order follow the.

Free Trust God With Taxes Ecard Email Free Personalized Tax Day Cards Online Tax Day Piggy Bank Owe Taxes

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Pin On Real Estate Is My Passion

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Tax For Expats Filing Abroad

Cypress Texas Property Taxes What You Need To Know

Tax Burden By State 2022 State And Local Taxes Tax Foundation

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

Homebuying Vs Renting A Cost Comparison 30 Year Mortgage Mortgage Payment Rent

Illinois Income Tax Rate And Brackets 2019

North Carolina Tax Reform North Carolina Tax Competitiveness

How Do State And Local Individual Income Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)