private reit tax advantages

In addition REIT investors benefit from a 20 rate reduction to individual tax rates on the ordinary income portion of distributions. Each of these 3 companies pays around 10 to its shareholders annually.

Starting A Private Reit Benefits For Real Estate Entities

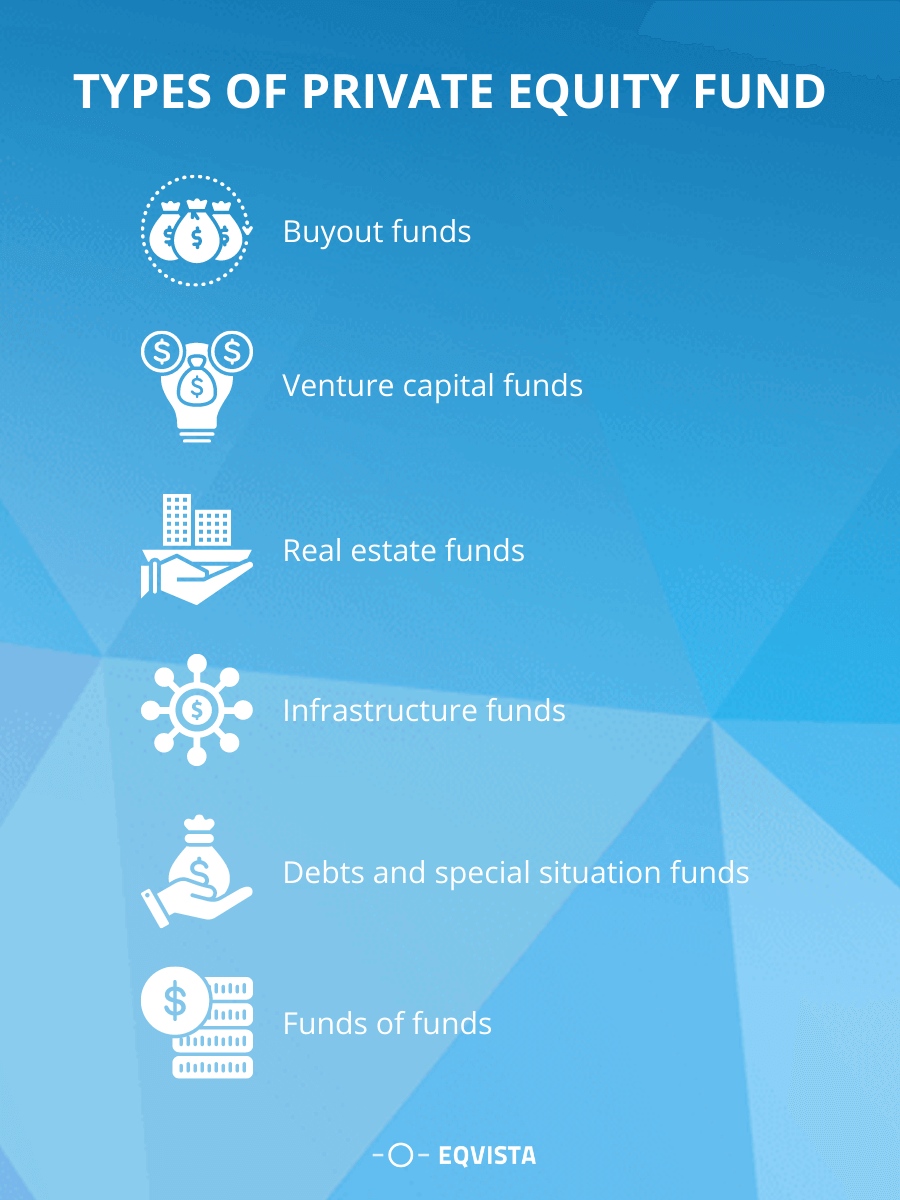

REITs function like a blocker corporation in a real estate investment fund so.

. Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. Ad Direxion Daily Real Estate Bull Bear 3X ETF. Discover why thousands of investors have chosen to invest with CrowdStreet.

Fundrise just delivered its 21st consecutive positive quarter. Individual REIT shareholders can deduct. Ive evaluated many private REITs.

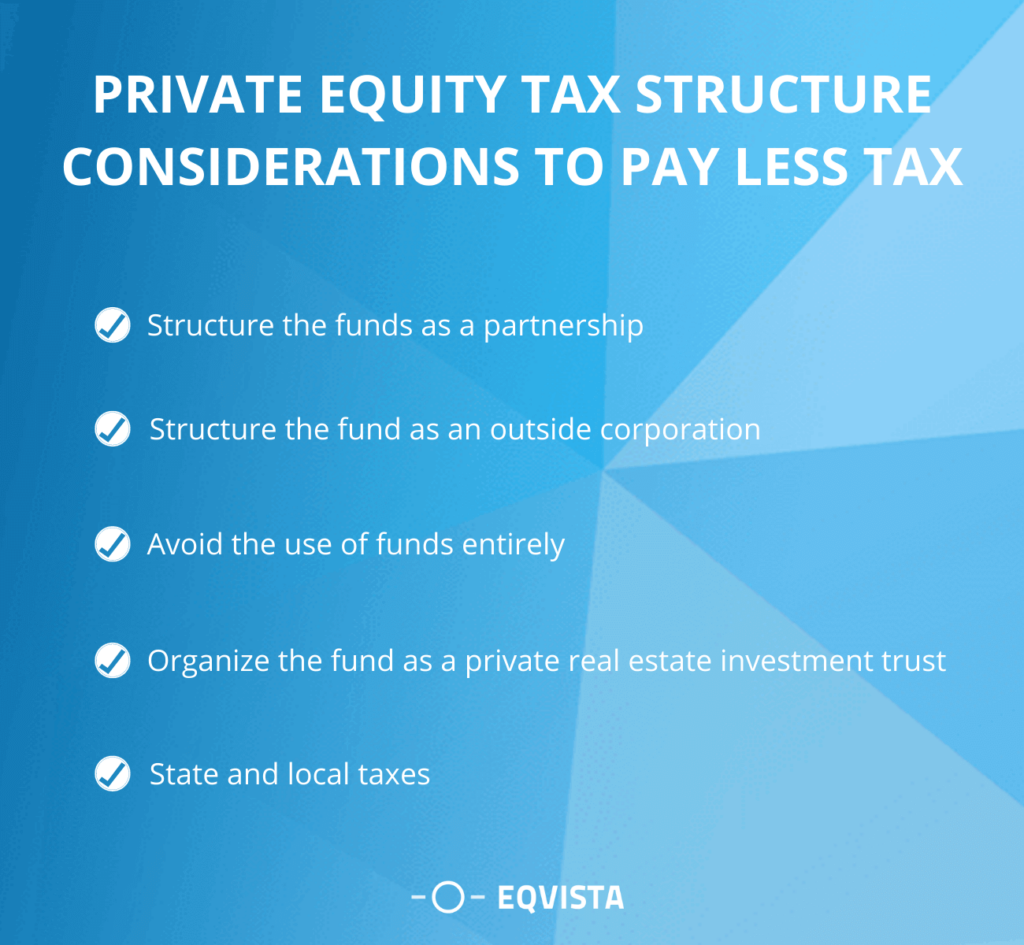

Under the Tax Act the use of REITs has the ability to provide significant tax benefits for not only tax-exempt and foreign investors. Understanding the Tax Benefits of REITs. The list below summarizes a few of the main advantages of starting a private REIT.

The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. Explore the Tax-Exempt Bond Fund of America. Ad Gain Access To Investment Cash Management Strategies At Bank of America Private Bank.

In most cases I feel that the drawbacks of private REIT investing outweigh the potential benefits. Ad Does investing in funds give you more control over your 500K in savingsor less. Ad Dont Settle for the Same Old Fixed Income.

Fundrise just delivered its 21st consecutive positive quarter. Heres my two cents on private REITs. Challenge the Old Buy Hold.

Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. REIT investors can deduct up to 20 of ordinary dividends before income tax is. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income.

Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. Download Fisher Investments free guide The Six Pitfalls of Funds. We Believe Diverse Perspectives and High-Conviction Investing Can Produce Better Results.

2 Distributions are not guaranteed and may be. Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets. 2 days agoREITs are categorized as tax pass through entities and pay no corporate taxes if they invest at least 75 of their assets in real estate derive 75 of their gross income from.

Wachovia Hybrid and Preferred Securities WHPPSM Indicies. Tax benefits of REITs. Ad This company is required by law to distribute 90 of its taxable income to shareholders.

Ad Explore active properties funds and REIT deals on the CrowdStreet Marketplace. Private Equity Real Estate investments are structured in a tax-efficient manner allowing investors to reduce taxable income through depreciation.

What Is The Bc Ndp Doing To Protect Renters From Real Estate Investment Trusts Reits Adam Olsen Mla For Saanich North And The Islands

Starting A Private Reit Benefits For Real Estate Entities

Taxation On Private Equity Funds Eqvista

Investing In Listed Infrastructure Nuveen

Integrated Liquidity Management For Private Markets Programs Neuberger Berman

Who S To Blame For High Housing Costs It S More Complicated Than You Think

/AnIntroductiontoStructuredProducts1-1a2eea05ef064d3fae32c8e1de618eaa.png)

An Introduction To Structured Products

Investing In Listed Infrastructure Nuveen

Investing In Listed Infrastructure Nuveen

Create Massive Leverage Through Passive Real Estate Investing Video Real Estate Investing Investing Real Estate Investor

Starting A Private Reit Benefits For Real Estate Entities

/Investingjourneypic-a9bb92f557694caaaa92b761eb2cadd9.jpg)

Introduction To Investing A Beginner S Guide To Asset Classes

5 Reasons Why Public Reits Outperform The S P 500 Origin Investments

Alternative Investments Definition Asset Types

Starting A Private Reit Benefits For Real Estate Entities